If you require a loan, it’s understandable to feel overwhelmed by the options available. The process can be daunting, with many lenders offering varying rates and terms. However, what if there was a way to access secured loans with competitive APRs while also enjoying a hassle-free experience? Look no further than the Cambridge Building Society. In this blog post, we’ll delve into how Cambridge Building Society can provide a seamless loan experience at an attractive 4.43% APR rate. So sit back, relax, and easily discover the possibilities of securing your financial future.

Introduction: How You Can Benefit from Hassle-free Secured Loans with Cambridge Building Society

If you’re in need of a secured loan and want to avoid the typical hassle associated with borrowing, Cambridge Building Society may be just what you’re looking for. Our secured loans are designed to provide our customers with quick access to funds without the stress that often comes along with traditional lending practices. With competitive rates as low as 4.43% APR, we offer one of the best deals on secured loans in the market today.

At Cambridge Building Society, we understand that making important financial decisions can be overwhelming, which is why we strive to make our lending process straightforward and easy-to-follow. We also believe in transparency when it comes to fees – there are no hidden charges or unexpected expenses when working with us.

With flexible repayment options and up to 90% property value available for qualified borrowers, securing your loan has never been easier! Keep reading for more information on how Cambridge Building Society can help you get started on your next venture without all the unnecessary stress.

Understanding Secured Loans: What You Need to Know before Applying

When considering a secured loan, it’s important to understand the basics before applying. A secured loan is a type of loan that requires collateral, such as a property or vehicle, to secure the loan. This collateral serves as security for the lender in case the borrower defaults on the loan. The amount you can borrow with a secured loan is typically based on the value of your collateral. It’s important to note that if you default on your secured loan, the lender has the right to repossess your collateral and sell it to recover their losses.

When applying for a secured loan, lenders will typically consider your credit score, income, and debt-to-income ratio. Having a good credit score and a low debt-to-income ratio can increase your chances of being approved for a secured loan with favorable terms and interest rates. It’s also important to shop around and compare offers from different lenders to ensure you’re getting the best deal possible. With Cambridge Building Society’s low 4.43% APR offer and transparent fee structure, they may be an excellent option for those in need of a hassle-free secured loan.

The Benefits of Choosing Cambridge Building Society for Your Secured Loan Needs

Choosing the right lender for your secured loan is crucial, and Cambridge Building Society is a reliable choice. With over 170 years of experience in providing financial services, they offer personalized guidance throughout the application process. Their expert team ensures that you understand all aspects of taking out a secured loan, from calculating interest rates to repayment options. By choosing Cambridge Building Society as your lender, you can benefit from no hidden charges or fees, making it easier for you to keep track of your finances. Additionally, their transparent approach means that there are no surprises when it comes to repayments. You can also rest assured knowing that they adhere to responsible lending practices and have favorable terms such as a low APR starting at 4.43%.

Exploring the Low 4.43% APR Offered by Cambridge Building Society

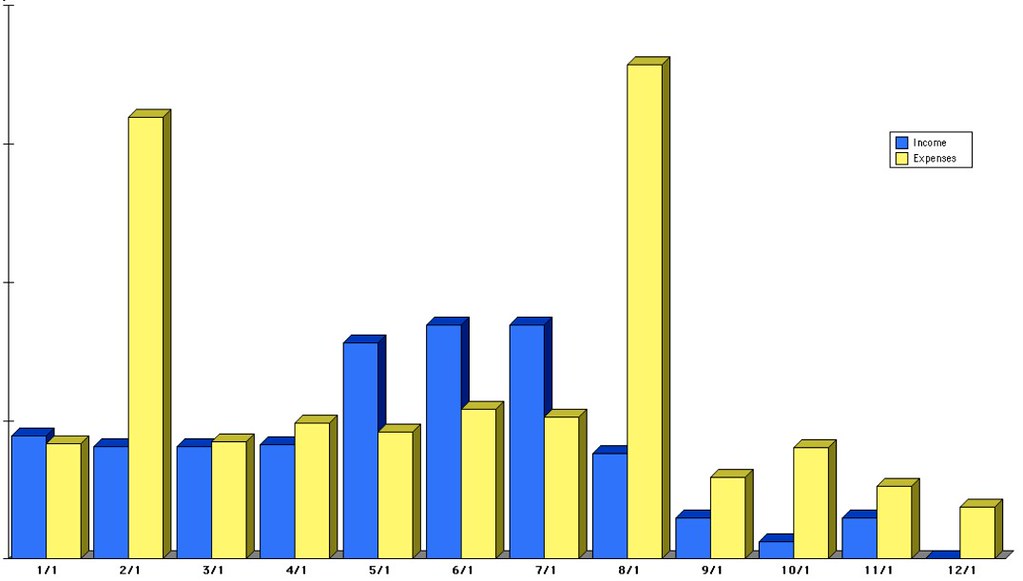

Are you tired of high interest rates on your loans? Look no further than Cambridge Building Society, with their competitive rate of only 4.43% APR on secured loans. This low rate can save you thousands over the life of your loan compared to other lenders in the market.

But don’t just take our word for it – compare for yourself and see the savings add up. Plus, with a fixed rate option, you can rest easy knowing that your payments won’t fluctuate unexpectedly.

At Cambridge Building Society, we believe in offering our customers fair and transparent rates without any hidden fees or charges. Our goal is to make securing a loan as seamless and stress-free as possible so that you can focus on achieving your financial goals.

Ready to take advantage of our low APR offer? Apply now and get one step closer to obtaining the funds you need at a great rate!

No Hidden Fees or Charges: Why Choosing a Transparent Lender Matters

Secured loans can come with hidden fees and charges that can quickly add up, leaving you with a larger debt than you anticipated. Cambridge Building Society understands the importance of transparency when it comes to lending, which is why we don’t charge any hidden fees or charges. We believe in providing our customers with a clear breakdown of all costs associated with their loan, so there are no surprises down the line. This means you can borrow with confidence, knowing exactly what you’ll be paying back each month. Plus, our low 4.43% APR offer means you’ll be getting a great deal on your secured loan. Choose Cambridge Building Society for hassle-free borrowing that won’t break the bank.

Maximizing Your Borrowing Potential: How to Qualify for Up to 90% of Property Value

At Cambridge Building Society, we understand that securing a loan can be a daunting process. That’s why we offer flexible options that cater to your individual needs. With our secured loans, you can borrow up to 90% of your property value, allowing you to maximize your borrowing potential.

To qualify for this option, you must have a good credit score and meet our affordability criteria. We will also require a valuation of your property to determine its current market value. It’s important to note that borrowing more than 75% of your property value may result in higher interest rates.

Our team of experts will guide you through the process and help you determine the best borrowing option for your needs. With our competitive rates and transparent fees, you can rest assured that you’re getting the best deal possible.

Contact us today to learn more about how we can help you secure the funds you need with our hassle-free secured loans.

Flexible Repayment Options that Suit Your Needs and Budget

At Cambridge Building Society, we understand that everyone’s financial situation is different. That’s why we offer flexible repayment options to make sure you can repay your secured loan in a way that suits your needs and budget.

You can choose from various repayment terms ranging from 1 to 30 years, allowing you to spread out the cost of borrowing over a longer period if necessary. You also have the option to pay off your loan early without any penalties or fees.

We offer both fixed and variable interest rates on our secured loans, giving you even more control over your monthly payments. If you prefer the stability of predictable monthly payments, a fixed rate may be right for you. On the other hand, if you want the possibility of saving money on interest over time, a variable rate might be more appealing.

Our friendly team is always here to help you find the best repayment plan for your unique circumstances. Contact us today to learn more about our flexible options!

A Step-by-Step Guide to Applying for a Secured Loan with Cambridge Building Society

Applying for a secured loan with Cambridge Building Society is a straightforward process. To get started, simply fill out an online application form or visit one of our branches. Our friendly and knowledgeable staff will guide you through the process and answer any questions you may have.

Before applying, it’s important to gather all the necessary documents, including proof of income, employment details, and property information. You’ll also need to provide details about the purpose of the loan and how much you wish to borrow.

Once your application is submitted, we’ll review it and assess your eligibility for a loan. If approved, we’ll provide you with a loan offer that outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any fees or charges.

If you’re happy with the offer, simply sign the agreement and return it to us along with any required documentation. We’ll then transfer the funds directly to your bank account.

At Cambridge Building Society, we strive to make the secured loan application process as easy and stress-free as possible. Contact us today to learn more about our secured loan options and how we can help you achieve your financial goals.

Frequently Asked Questions About Secured Loans and Cambridge Building Society

Secured Loans are a popular choice for borrowers who want to obtain large amounts of money with longer repayment terms. However, it’s essential to understand that this type of loan requires collateral such as property or vehicle ownership. At Cambridge Building Society, we offer secured loans with competitive interest rates and transparent fees. You can borrow up to 90% of your property value and enjoy flexible payment options depending on your financial situation.

Before applying for a secured loan, make sure you understand the risks involved in securing your home against the debt. Missing payments could lead to repossession by the lender if the borrower fails to keep up with monthly repayments.

It is crucial to work out how much you can afford before taking out any form of credit, including secured loans from Cambridge Building Society. Always ensure that you have budgeted adequately so that payments continue even in difficult times.

If you’re considering accessing finance via our secure lending products at Cambridge Building Society be advised that requirements are usually tough because there has been an increase in competition over time; nonetheless, our experts will guide through every step ensuring client satisfaction throughout the procedure.

Testimonials From Satisfied Customers Who Chose Cambridge Building Society

Cambridge Building Society has helped numerous customers secure their financial future with hassle-free secured loans. Here are some testimonials from satisfied customers who chose Cambridge Building Society:

“I was impressed with the low APR offered by Cambridge Building Society and the transparent fee structure. The application process was straightforward, and I received my loan quickly. I highly recommend them.” – John D.

“I needed a loan to fund some home renovations, and Cambridge Building Society offered me a great deal with flexible repayment options that suited my budget. The team was friendly and helpful throughout the process.” – Sarah T.

“Cambridge Building Society helped me qualify for a loan of up to 90% of my property value, which was much higher than what other lenders were offering. I appreciated their personalized approach and attention to detail.” – Mark R.

Choose Cambridge Building Society for your secured loan needs and experience the same level of satisfaction as our happy customers.

Cambridge Building Society’s secured loans offer an excellent opportunity for anyone looking to borrow money without the hassle of hidden fees or charges. With a low APR rate of 4.43%, flexible repayment options, and the potential to qualify for up to 90% of your property value, their offering is hard to beat. By following our step-by-step guide and taking advantage of Cambridge Building Society’s transparent lending practices, you can access the funds you need while feeling confident that you are making a wise financial decision. Don’t just take our word for it – check out what satisfied customers have said about their experience with Cambridge Building Society’s secured loans.